The fourth quarter of 2006 will be driven by a country we named as a wild card earlier this year: Iran. More precisely, the dynamics that previously were set in motion by Iran will be playing out through the end of 2006.

What happened during the third quarter was fairly simple in retrospect. The Iranians read Washington as weak and its threats of sanctions or military action as hollow. They also saw the United States as being vulnerable in Iraq. Iran therefore refused accommodation over the orientation of an Iraqi government and triggered a crisis within the Shiite community and, more important, between the Shia and the Sunnis. At the same time, Iran encouraged actions that drew Israel into a war it was not prepared for militarily or psychologically. Hezbollah, trained and armed by Iran, held its own. Given the history of Arab military performance against Israel, not collapsing constituted a major victory. Coupled with events in Iraq, Iran was suddenly driving the regional system -- and given the importance of that system, driving the global system as well.

There are a number of competing processes under way now. First, Iran and the Shia have become the drivers in the Middle East. Second, this has generated an inevitable reaction against Iran among Sunni Arabs in general, and by Saudi Arabia in particular. Third, as Iran becomes more powerful and more threatening in the Arabian Peninsula, the Saudis are looking for a counterweight to it. The only counterweight is the United States. Fourth, neither the United States nor the Saudis want circumstances to develop into a situation in which the United States is militarily defending the Saudis.

Therefore, the main battleground must be Iraq. The Saudis want the United States to defend Sunni interests against the Shia and to prevent Iranian domination of the region. The United States wants to do that, but it cannot simply remain bogged down in a futile attempt to pacify Iraq. This leaves the United States with two options. One is a redeployment in which the United States withdraws from security responsibilities for Iraq but keeps U.S. forces there, blocking the Iranians. The second option is to forge a political settlement in Baghdad. But there will be no political settlement without Iran.

The Iranians have now launched a very public initiative to redefine their posture. Iran sees itself as having achieved a real but potentially transient advantage. Its options now are to try to build a permanent advantage, or negotiate from a position of strength. Since the next move would involve the withdrawal of U.S. forces from Iraq and Iran's emergence as a superpower in the Gulf region -- and since the Iranians must have serious doubts as to whether this will happen -- this would seem to be an outstanding moment in which to negotiate the status of Iraq and, alongside Syria, the status of Lebanon.

There is an intervening event: the U.S. congressional elections. Iran, having helped bring Jimmy Carter down in 1980, is well aware of U.S. politics and how to manipulate them. The problem is that the outcome of this election is unclear. If the Republicans were handed a massive defeat in November --for example, losing both houses of Congress -- and if the Democrats trapped President George W. Bush by ending funding for U.S. troops in Iraq, that would be the ideal time for Iran to negotiate. But it is simply not certain how the election will come out. If the Republicans hold both houses, which is possible, Iran will face an even more intractable Bush -- one potentially capable of breaking out of the bind. Therefore, the logic of the situation is that Iran will want to negotiate in October, when Bush and the Republicans need a political triumph. Alternatively, the Iranians could, through proxies, attempt some major action in Iraq that would shatter voter confidence in Bush and guarantee a Republican defeat in the elections.

If this appears to be an America-centric forecast, it is, but that is not simply because we are Americans. It is focused on the United States and Iraq because, as stated in our second-quarter forecast, this issue continues to be the driver of the international system. Russia, for example -- in its moves to re-establish itself as a great power with a sphere of influence -- is using Washington's distraction over Iraq as a means of putting the United States on the defensive. Similarly, China is using the space to pursue its own internal interests. The international system revolves around the only superpower -- and when that superpower is in trouble, everyone else plays off of that. Given the force and skill with which the Iranians have played, we might do better to call this an Iran-centric quarter.

Still, there are trends elsewhere that are of greater long-term interest. Internal Chinese politics are keying off the country's fundamental economic crisis, which has been driven by a financial system choked by bad debts and resulting social instability. The recent removal of the Chinese Communist Party chief in Shanghai -- an enormously powerful individual -- on charges of corruption shows that there is a political upheaval under way, and that the landscape is changing with increasing speed. As Russia did early this decade, so China is now doing: It is reemphasizing the state and trying to create a situation in which it can manage its problems.

But it is the failure of the United States to create a political solution in Iraq that will continue to drive the international system, and which will make the fourth quarter Iran's moment. For now, Iran is driving the system. We continue to view Iran as a rational power that is trying to assert itself within the Muslim world, within the region and within Iraq. Therefore, Tehran will continue to shift between aggression and conciliation, keeping the United States and the world off-balance.

Middle East: Iranian Ambitions, U.S. Interests and the Arab States

In our third-quarter forecast for the Middle East, we made a fundamental miscalculation. We underestimated the extent to which Iran would be willing to push geopolitically into the Middle East and demonstrate what it could do should the United States try to thwart its efforts to rise as the regional hegemon. Washington and Tehran's expected accommodation regarding the status of Iraq did not pan out, as Tehran determined it was not necessary to settle for less than a strong hand in the future of its western neighbor.

As a result, we were unable to foresee the Shia-Sunni conflict in Iraq spilling over into the region. We did not anticipate Hezbollah's move to abduct Israeli soldiers, which triggered the 34-day conflict in Lebanon, the most significant event in the region this past quarter. We missed Syria's ability to stage a geopolitical comeback after being forced to withdraw from Lebanon. In short, a single flaw in our assumptions on Iranian behavior compounded into a fundamental miscalculation of regional events.

Sunni nationalist violence continued through the third quarter, but the expected rift between transnational militants in al Qaeda and Iraqi jihadists in the Mujahideen Shura Council umbrella alliance, which we said would exacerbate matters for the jihadists, did not take place. At the national level, Iraq's principal communal groups returned to the struggle over federalism, and consequently the issue of the distribution of oil revenues. Serious rifts within the Shiite alliance surfaced, and Tehran exploited those rifts in an attempt to shape the new Iraqi state.

In the fourth quarter, Iran -- particularly its relations with Washington and the reactions of its Arab neighbors -- will be the driving force in the Middle East. Tehran has already demonstrated its reach in the region with the Hezbollah conflict, and there are signs that Tehran could encourage a new series of militant attacks inside Iraq in the near future. At the same time, there are signs of a resurgence of militants in the region, spurred by both al Qaeda and Iran. These two drivers -- Iranian assertion and resurging nonstate militants -- will keep the political and security situation in the region in flux.

The quarter will begin with Iran already taking a conciliatory approach toward the United States. The Iranians feel they are in a comfortable position to negotiate in the wake of the Israel-Hezbollah conflict, and will offer the Bush administration a diplomatic opening. Tehran's assumption is that Washington believes it would benefit from a political resolution in Iraq through Tehran in time for the U.S. congressional elections in November. The United States, however, cannot afford a deal that will empower Iran regionally. Meanwhile the Iranian government is accelerating efforts to carve out a Shiite federal region in southern Iraq and undermine U.S. attempts to broker a different kind of political agreement between Iraq's major factions at the national level. Therefore, Washington is simply unwilling and unprepared to accept a deal with Tehran that may or may not allow it to resolve the Iraqi issue but will certainly end up strengthening Iran.

If Iran cannot extract what it wants, it will have no other choice but to once again demonstrate the negative consequences of Washington's refusal to engage Tehran. With both Israel and the United States bogged down with domestic issues, Iran has room to be adventurous this quarter and pursue its larger strategy of consolidating Persian dominance in the region. A dramatic shift in the regional balance of power is taking effect, with rising Shiite influence casting a shadow over the Arab regimes. In order to continue with its aggressive geopolitical push, Iran must ensure that conditions remain ripe for an offensive aimed at forcing the United States into negotiations on Tehran's terms.

Iran will use its Shiite extensions in Iraq, Saudi Arabia, Kuwait and Bahrain to demonstrate its ability to act as the spoiler in areas where the United States is heavily invested. One key area in which Iran could create problems is Bahrain, where parliamentary elections are to be held in October. Tehran has considerable influence with the country's majority Shiite population, whose principal political groups are Iranian-leaning Islamists. Fearing Iran's rapidly expanding influence and already wary at the prospect of Iran and the United States trying to come up with a political arrangement for Iraq, the Arab regimes are pressuring Washington to counter Iranian ambitions. Meanwhile, a political resolution in Baghdad -- the basis for a U.S. exit strategy -- is quickly slipping through U.S. President George W. Bush's fingers. Iran will focus on reinforcing the idea that the United States has lost its grip in the region and that Tehran still has a number of Shiite assets it can employ against its Arab neighbors. There already have been indications of Shiite militants infiltrating Kuwait and Saudi Arabia from Iraq's heavily Shiite south.

The main focus for Iran's push against the United States will be in Iraq, where there are strong indications that Iran is arming Shiite militants to carry out a series of attacks against U.S. forces in October. Tehran has influence among a variety of proxy groups -- political as well as militant -- in the country that it could use to create problems for the Bush administration before the U.S. elections. A rising body count in Iraq will have a definite impact on the elections, a factor that Iran believes will steer the United States toward conceding to demands that Washington recognize its role in Iraq and the region. Attacks against U.S. forces in October, or even hints of a Shiite militant offensive against U.S. forces, are still unlikely to produce the desired results for Iran this quarter and will entrench the United States even further in Iraq. Meanwhile, Washington needs to contain Iran, but it does not have the assets to foment a mass uprising against the clerical regime. What it is trying to do -- and will likely intensify during the third quarter -- is activate separatist action within Iran from ethnic Arab, Kurdish, Baluchi, Sunni and Azeri groups. This will be a key U.S. method to place impediments in the path of an increasingly assertive Iran.

With limited options, U.S. forces in Iraq will be forced to tough it out while former U.S. Secretary of State James Baker plays a leading role in trying to restart negotiations among Iraq's political factions. The Bush administration is counting on the Baker initiative as its way out of the current crisis; it is also the U.S. alternative to having to deal with Iran. Meanwhile, Tehran will continue efforts to consolidate its influence in Iraq through the federalism bill and by establishing a close working relationship with Baghdad. Iran also will successfully manipulate the negotiations over its nuclear program, blunting any U.S. moves to impose punitive action against Iran by toning down its belligerent rhetoric over uranium enrichment when the need arises.

The big political issue that will preoccupy Iraq for the remainder of the year will be the federalism bill tabled by the ruling Shiite coalition, the United Iraqi Alliance, which will entail intense debates and negotiations on amending the constitution of the country. There will be intense debates and negotiations on amending the Iraqi constitution. The bill is designed to alter the structure of the state by creating autonomous federal zones in southern and central Iraq along the lines of the Kurdistan region in the north. This process, which threatens the Sunnis' political and economic positions, will fuel a flare-up in Sunni nationalist insurgent violence. As has been the case before, the Sunnis feel they can use the violence to enhance their bargaining power on the negotiating table. Al Qaeda and the jihadist alliance, which has been weakened by the death of Abu Musab al-Zarqawi, will try to use this as an opportunity to revive itself under a new leader. Furthermore, Ramadan (which falls in September and October), will only add to the uptick in insurgent activity. The federalism issue and its exploitation by al Qaeda could also worsen the sectarian situation.

Domestic political developments will not meaningfully change the U.S. military posture before the year is out. The U.S. military has already dramatically departed from its plans for a drawdown. Units like the 172nd Stryker Brigade have had their deployments extended even as new units cycle into the country and the U.S. Army tightens its deployment window. As of Sept. 25, more than 140,000 U.S. troops were in Iraq and the U.S. military expects to maintain that number until at least April 2007. Previous timetables had called for 100,000 troops to remain in Iraq by December 2006.

Despite the 325,000 Iraqi security forces that are scheduled to be operational by the end of the year, the United States and United Kingdom will remain the only decisive military forces in-country. Operation Together Forward continues, and has seen some measure of success, but it clearly shows the necessity of the U.S. military in effective operations. The Iraqi military -- still not performing up to expectations -- will continue to be forced to the forefront of security operations as it rapidly approaches the point at which it must sink or swim.

In Israel, Prime Minister Ehud Olmert's government seems to have avoided the threat of collapse that emerged after the Israel-Hezbollah conflict for two reasons. First, there is no viable political alternative to the Kadima-Labor coalition government, and thus no serious challenger to Olmert. Second, Olmert's government has shown that, though it did not force a military settlement on Hezbollah, it has been able to contain the threat through a peace deal that created a difficult situation for Hezbollah: the Shiite Islamist movement was forced to accept an Israeli military presence in southern Lebanon until the deployment of an international force. Furthermore, Israeli demands for a cease-fire allowed the Lebanese government to exert a certain degree of counterpressure on Hezbollah, which forced the movement to work with the Siniora government because it did not want to empower anti-Hezbollah factions.

Hezbollah will not be disarmed, but it will be on good behavior and show that it is cooperating with the cease-fire agreement. Israel cannot stomach another confrontation with Hezbollah any time soon. The Israeli military has entered a period of re-examination and preparation to reverse, at some future date, the perception that an Arab force can withstand the military might of the Israel Defense Force. In the meantime, Israel will be working through third parties to secure the release of its kidnapped soldiers.

In the Palestinian territories, a recent deal between Hamas and Fatah could produce an administration that alleviates social and economic concerns in the West Bank and Gaza. But the political and security situation will remain largely unchanged because of Hamas' unwillingness to recognize Israel and its inability to agree on a comprehensive power-sharing mechanism. It is possible the revamped Palestinian National Authority (PNA) could recover its international standing dividing the United States and the European Union. There are signs that a deal will be struck for the release of the Israeli soldier being held by Hamas.

Elsewhere in the region, Syria will spend the rest of 2006 not only trying to re-establish its influence in Lebanon, but also trying to emerge as a regional player, competing with Saudi Arabia for influence in Lebanon and with Egypt in the Palestinian territories. Riyadh will counter Iranian moves in the region by trying to support Sunnis in Iraq and Lebanon, thus adding to Sunni-Shiite tensions in the region. There are reports of talks between the Saudis and the Israelis, who share an interest in countering a rising Iran. Egypt will be more concerned about Syria's bid to restore its stature within the Levant, especially regarding the Lebanese and Palestinian conflicts, than with the rise of Iran. We already have seen the Egyptians speak of Iran as an important player in the Middle East. Unlike Riyadh, Cairo does not see Iran directly meddling in its immediate geopolitical vicinity, whereas Damascus has been trying to emerge as a mediator between Fatah and Hamas in the formation of the PNA coalition government. Cairo will exploit its announcement that it is resuming its nuclear program as a bargaining chip to gain concessions from the United States on other issues.

Al Qaeda-linked militants can be expected to play a greater role in Egypt, the Levant, Jordan, Saudi Arabia and the Gulf Cooperation Council states. Al Qaeda's No. 2, Ayman al-Zawahiri, in a video marking the fifth anniversary of the Sept. 11 attacks, warned of attacks against oil targets in the Persian Gulf region. The first manifestation of this strategy came Sept. 15, when jihadists staged a failed attempt to strike at two separate energy facilities in Yemen. Al Qaeda's prowess as a militant movement is clearly degrading, but the group has maintained assets in the region that could become active in the coming quarter.

The region's relationship with the West will become a bigger issue during the quarter. Ramadan will create an opportunity for conservative and Islamist forces to fan the flames of animosity toward Christians in the region and the Christian West. In Kuwait, a fight is already brewing among Islamists, the government and the Christian community (primarily Indians, Egyptians and Syrians) over the construction of a new church. In the West Bank, militants have firebombed churches. Recent comments from Pope Benedict XIV that many Muslims deemed insulting will further complicate matters.

Global Economy: The Down Side of the Cycle

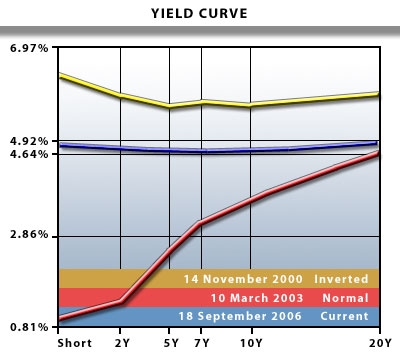

The economic cycle finally has crested. The yield curve has inverted (albeit only slightly) and stayed that way; commodities of all sorts have come off of their highs; and growth in the United States and Asia is slowing, with the American housing market (finally) showing signs of strain. Only European growth is doing better than normal, having surpassed U.S. growth in the second quarter of 2006 for the first time since 2000. At roughly 2 percent on an annualized basis, however, European growth is hardly robust enough to resist the downdrafts from elsewhere.

Despite omnipresent signs of a slowdown, many investors are behaving as if global growth were accelerating, not stalling. Investment monies are flowing hot and furious into the developing world, and initial public offerings in particular are garnering record amounts despite an utter dearth of transparency, as with (Russian state oil firm Rosneft,) or a well-chronicled litany of shortcomings, as with the (Chinese state-owned banks).

There is a fancy economics term for this: "irrational exuberance" or, more simply, a market top. And just as in physics, what goes up must come down. There is a not-quite-so-fancy economics term for that: "recession."

The fourth quarter will be a time of sliding asset and commodity values as slowing growth pulls the system back from its giddy highs. This is not a process that can happen overnight, however. U.S. growth is unlikely to dip into the negative until the first half of 2007, and a formal recession -- two consecutive quarters of negative growth -- is hardly a foregone conclusion. But make no mistake: At the end of 2006 it will have been 81 months since the last American recession ended, and the average U.S. expansion is only about 57 months. The United States is most certainly due for a correction.

Both Europe and Japan will follow the United States down, albeit with a lag of unlikely more than a quarter. Recessions in both places -- particularly in Europe -- tend to be a more protracted affair. This one is unlikely to be different except in one way. While interest rates in the United States have already returned to a "natural level" of 5.25 percent in the aftermath of the 2001 recession, in the eurozone they are only 2.75 percent, vs. only 0.25 percent in Japan. Unlike the United States, neither the Europeans nor the Japanese have many tools to get their economies going again when they start having problems.

Now more than ever they will be forced to depend on the resurgence of strong demand from the United States -- which means that their recoveries will have to wait until after the American one has built steam. Chinese demand will help as well and we do not expect Chinese growth to slide along with the developed world.

This is not because the Chinese economy is more resilient -- hardly -- it is because the Chinese economy is not based upon market principles. In the United States profit and sustainability are the keywords; in China they are market share and maximum employment. Bottom lines are not important; maintaining a fast throughput of cheap loans is. Such a values disconnect does make one largely immune to the business cycle, but at the cost of rampant inefficiency, pervasive corruption and fraying social stability. China's system will not suffer a recession due to the American slowdown, but it will collapse under its own weight -- just not this quarter.

Elsewhere the recession will not be a cataclysmic collapse of an entire system such as the 1997 Asian financial crisis, or a systemic shock such as we expect in the United States once the "baby boomer" generation retires, or even the shattering of the Chinese banking system that we believe is inevitable (but not imminent). This is a purely cyclic development that happens during every economic cycle when people with cash to burn begin putting it into "assets" that ultimately will fail (something similar happened in 2000 when there was an excited rush toward various IPOs).

This is an altogether normal and healthy part of the system in which some of the inefficiencies get shaken out and growth patterns become much more rational. Assuming that no geopolitical developments adversely affect the economy on a global scale -- a North Korean nuclear test would certainly rock the boat -- this will be a shallow recession that will last a few months and finish well before the end of 2007.

East Asia: A Stern Beijing and a 'Testy' Pyongyang

Iran's assertiveness in the third quarter had a ripple effect well beyond the Middle East. As U.S. attention was drawn to Iraq and Afghanistan, and further to the Israel-Hezbollah situation, China was left as little more than a "peripheral" issue -- which suited Beijing just fine. Thus our prediction that Washington would increase pressure on Beijing, likely reducing China's room for maneuvering and possibly encouraging closer relations between Beijing and Moscow, did not manifest.

In the second quarter of 2006, the United States, seeing a potential break in Iraq, began reasserting its own security concerns over China. However, by the end of the third quarter, U.S. Treasury Secretary Henry Paulson revived former Deputy Secretary of State Robert Zoellick's "responsible stakeholder" approach to Beijing, signaling a continuation of the cooperative and coercive approach to China rather than a shift to a more confrontational and "containment" approach. As we move into the fourth quarter, Chinese fears that the "China threat" and calls for yuan reform will strongly affect the U.S. congressional elections are unlikely to play out.

Washington's slight ease-up does little to abate China's deeper domestic troubles: Reining in corrupt local officials and recentralizing the government, moving investment inland and correcting the wealth gap. Beijing is taking a two-track approach to dealing with these internal problems.

First, Beijing is taking a more internationalist stance. This keeps other countries focused on China's international interactions rather than its domestic issues. It also shows the Chinese that their country is a "big power" and builds a sense of nationalism that Beijing hopes will cancel out urges to protest or dissent as the government grapples with economic and social problems. Beijing's international involvement ranges from the North Korean nuclear crisis to the U.N. peacekeeping force in Lebanon. Beijing's growing internationalism on the economic and rhetorical fronts is soon to be matched, at least in part, on the security front. The promise of 1,000 troops for Lebanon is a significant commitment and could signal a shift in the level of Chinese deployment of forces abroad beyond the minimal number involved in various peacekeeping missions.

The other half of Beijing's approach to internal issues involves the central government tightening its hold over the economy, taking its fight to the scandal-ridden Shanghai government, where Shanghai Party secretary Chen Liangyu was just sacked on corruption charges, serving as a warning for other officials who dare defy the central government, and making final preparations for the opening of the banking system. On Dec. 11, China opens its banking sector to foreign competition as part of its commitments to its World Trade Organization (WTO) entry. As the date nears, Beijing will issue numerous regulations geared toward discouraging foreign competition and encouraging foreign banks to move into China's interior. China will attempt to follow the letter of the WTO requirements, though the spirit will be violated.

The Financial Committee, chaired by Premier Wen Jiabao, meets in November, and will give a clearer view of the planned monetary and economic policies for the coming year. Yuan reform is certainly not on the agenda.

China is seeing a slowdown in foreign direct investment (FDI), though Beijing is trying to mitigate the psychological impact of the shift by calling for decreases in FDI and emphasizing quality of investments over quantity. This will continue through the fourth quarter, as will the rise in Chinese money flowing to safer havens. Domestically, the All-China Federation of Trade Unions (ACFTU) will accelerate its attempts to unionize more than half of the foreign-vested businesses in China. The government is also experimenting with appointing labor union chiefs in some cities; companies cannot fire government-appointed labor chiefs because they are not employees. Though the ACFTU will do little aside from unionize, the federation's actions are backed by Beijing and lay the groundwork for greater government influence in foreign businesses and better control of the workforce in the future.

China's key tool of economic control, however, will be political. There is a pension scandal raging in Shanghai, where Shanghai Party Secretary Chen Liangyu was just sacked, with links to officials throughout the city's bureaucracy and in the central government. Shanghai was the stronghold of former President Jiang Zemin and former Premier Zhu Rongji, and the pension scandal will further undercut Jiang's political base. It also serves as an example to other coastal governments.

President Hu Jintao is pushing an economic policy different from Jiang's -- the redistribution of wealth from the coast to the interior, tighter management of coastal investments and a recentralization of control of key industries. This has brought significant resistance from coastal wealthy political and party elite, who make their fortunes on their relatively freewheeling economic relations with foreign and domestic investors. Centralized control cuts into their power and thins their wallets.

With the ousting of Chen Liangyu, Beijing's message has been delivered: The central government will no longer tolerate local "initiative" when it involves corruption, collusion and a general disregard for central government directives. This warning is most acutely directed at the Guangdong area. Much of this will play out at the Communist Party plenum in October, which itself will set the stage for the 17th National Congress of the Communist Party of China in 2007, a meeting that will likely decide the successor to Hu and to his economic policies.

In neighboring Japan, the transition from Prime Minister Junichiro Koizumi to Shinzo Abe will drive the fourth quarter. Though he is Koizumi's handpicked successor and will follow and expand on Koizumi's policies and plans, Abe needs to establish himself. One of the first things he will do is visit China and South Korea. This would bridge the widening rhetorical divide between Japan and its neighbors. Abe said in his campaign that any visits to the Yasukuni Shrine will be in his personal capacity, but given that Yasukuni is only an emotional concern and not the real problem between the countries, the goodwill will only last as long as it suits Beijing or Seoul.

Abe's main focus during his term will be redefining the Japan Self-Defense Forces. The path put in place years ago and accelerated by Koizumi is likely to reach fruition under Abe; the Japanese constitution will be altered, Japan's defense forces will become a "real" military and Tokyo will take a more active role in international security operations while enhancing its forces' technological capabilities and engaging in additional training and organization. This will not all play out in the fourth quarter, but Abe will use his first months in office to set the stage. Though he has suggested he wants to re-strengthen ties with China and South Korea, Abe will seek a stronger role in Southeast Asia to lock in resources, manufacturing bases and strategic positions for any future China contingency.

In South Korea, there are three key issues, all tied to the United States: the free trade agreement negotiations, the restructuring of the wartime command of U.S. and South Korean forces and the North Korean nuclear issue. The free trade talks, expected to be concluded by year's end, will grow ever more contentious as they move toward completion. Increasing South Korean protests and demonstrations, both in South Korea and in the United States, are likely.

Regarding the U.S.-South Korean military alliance changes, Seoul's reclamation of control over South Korean military forces is being characterized as South Korean nationalism and anti-Americanism; however, it is driven as much -- if not more -- by the United States' evolving Asian-Pacific defense posture. It has nevertheless become a hot-button issue in South Korea and will remain a point of contention between the ruling and opposition parties, and within the ruling party itself. In the mid-term, the changing alliance structure is accelerating South Korea's arms purchases, particularly of reconnaissance aircraft and additional naval assets -- systems designed for dealing with Japan as much as North Korea.

South Korea will spend the fourth quarter seeking closer engagement with North Korea while encouraging coordinated efforts with the United States and China to engage, rather than isolate, North Korea. Seoul will ignore new sanctions on North Korea as tensions with Washington rise, all the more so as Pyongyang sends signals of a potential nuclear test.

That is one of the big wildcards for the quarter. Pyongyang has indicated that it might finally be ready to "prove" its deterrent capability, and this is stirring up action all around the region. Beijing has reassured Pyongyang of its military alliance with North Korea and dispatched a new ambassador to help the North Koreans better understand U.S. policy. Japan is adding to sanctions on North Korea and using the fear of a nuclear North Korea to justify greater defense expenditures and more liberal interpretations of the constitution (before finally changing it). Despite its threats, North Korea has thus far found strategic ambiguity regarding its nuclear program to be the best policy, and as long as it can get the other nations to respond, it does not need to carry out the test and lose the bargaining card.

In Taiwan, protests and demonstrations against embattled President Chen Shui-bian will continue, internal political bickering will intensify and there is a good chance Chen will be forced to resign, though it might not happen in the fourth quarter. For the most part, China will remain on the sidelines so as not to give ammunition to the remaining pro-Chen forces, and Washington will hold back from intervention as well. Structurally, despite the bickering, it appears Chen will ride out the storm. For Beijing, the lack of consensus in Taiwan is just fine, and for Washington, as long as Taiwan is not pushing the independence issue too sharply the status quo can be maintained.

Thailand will continue to be ruled by a junta - calling itself the Administrative Reform Council - with Gen. Sonthi Boonyaratglin as the leader, guiding interim prime minister retired Gen. Surayud Chulanont. Ousted Prime Minister Thaksin Shinawatra will face criminal charges, and there will be some disaffected voices from the countryside and pro-democracy activism over the military coup. Overall, however, the scene will remain relatively calm and stable in the next quarter. One of Sonthi's primary aims will be to quell the violence in the south, which he will begin to address almost immediately. As a Muslim who has furthered dialogue in the past, it is likely that he will be more successful than Thaksin in bringing change to this chaotic region.

Finally, though there is no specific intelligence suggesting an attack in Indonesia, the fourth quarter is usually the time for Jemaah Islamiyah or its offshoots to strike.

Former Soviet Union: Moscow Strengthens its Grip

Our third-quarter forecast for the former Soviet Union (FSU) was mostly correct. We did not forecast the United States' relative inattention toward Russia, and the lack of pressure from Washington prevented the increasing Sino-Russian cooperation we anticipated. However, Russia did adopt the expected generally confrontational attitude toward the United States. Moscow sustained significant pressure on its periphery, maintained its contacts with the Middle East and continued consolidating power. Elsewhere in the region, we correctly forecast that Ukraine's rekindled "Orange" alliance would not survive, and that tensions with Georgia's Russian-supported secessionist regions would escalate into several significant skirmishes. We were also correct in saying that the Central Asian regimes would crack down on what they deemed militant Islamist activity.

In the final quarter of the year, Washington will be too focused on the ongoing conflict in Iraq, tensions with Iran and North Korea and congressional elections to spare much attention for Russia. Moscow will be able to pursue its agenda, though occasional diplomatic barbs are sure to come from the United States. The Kremlin will continue its quest to consolidate power. As the Kremlin has chosen to strengthen domestic control instead of promoting economic growth through foreign investment, the energy sector, along with other sectors deemed strategic by the Russian government -- particularly steel, aerospace, minerals/mining and defense -- will be further consolidated.

The big event this quarter in the FSU is the NATO summit, scheduled to begin Nov. 28 in Riga, Latvia. That is definitely too close to home for Russian comfort and will draw defensive statements from the Kremlin. However, the alliance is unlikely to jab directly at Russia's periphery by offering paths to membership for Ukraine and Georgia; NATO will concentrate on the Balkan prospective members instead.

Russia will maintain its focus by installing officials who perpetuate the Kremlin's policy and restricting outside access to strategic sectors such as energy and defense. Ahead of the 2007 parliamentary and 2008 presidential elections, Russian President Vladimir Putin is ensuring that his policies will be perpetuated by his chosen successor (unless he chooses to amend the constitution and retain the top post himself). Putin's anti-corruption drive -- the main method of removing officials from strategic posts and installing officials who are friendlier to the Kremlin -- is likely to continue as the elections draw near. First Deputy Prime Minister Dmitry Medvedev and Deputy Prime Minister and Defense Minister Sergei Ivanov will maintain high public profiles, promoting internal revitalization projects and a strong stance on security. Presidential aides -- especially Igor Shuvalov and Vyacheslav Surkov, who are seen as the mouthpieces for Russian policies -- will further articulate the presidential position.

Energy remains a top priority in Russian policy as state-controlled companies tighten control over domestic producers and energy supplies are used to pressure foreign customers. Oil giant Rosneft and natural gas monopoly Gazprom will continue to purchase domestic assets to better control the supply. Gazprom in particular will continue its efforts to acquire a stake in the Sakhalin-2 operations at the expense of Royal Dutch/Shell, and will not stop until it either succeeds or the project is shut down.

Russian energy policy will continue to affect Europe as the continent prepares for the winter. Russia will likely raise gas prices on natural gas for its Western customers, but better relations between Moscow and Kiev could prevent another natural gas cutoff such as the one Ukraine and Europe saw last winter. However, Russia could still use alternating threats and promises about energy supplies as a tool to draw and keep Europe's attention.

Control over its periphery is also integral to the Kremlin's strategy. Ukraine's government has taken a more conciliatory stance toward Russia since Viktor Yanukovich became prime minister, though tensions remain between Yanukovich and the pro-Western Ukrainian President Viktor Yushchenko. The coalition has not yet been formed, and the process promises to be just as drawn-out and convoluted as it has been since the parliamentary elections. However, regardless of whether the Our Ukraine Party joins the ruling coalition, the Yanukovich-led Anti-Crisis coalition already has a parliamentary majority, with the Socialists and Communists on board. Former Prime Minister Yulia Timoshenko has moved into the opposition and will keep disrupting the parliament's work whenever it suits her interests, but with little tangible result.

Ukraine and Gazprom will complete natural gas pricing talks this quarter. They must settle on a price for the final quarter of 2006, and on prices for 2007 and beyond. Ukraine's new energy negotiators are on much better terms with Gazprom's leadership than were their predecessors, which means price increases will be less severe. Prices will go up after the new year, since Ukraine's supplier, Turkmenistan, has negotiated a price increase with Gazprom from $65 to $100 per 1,000 cubic meters. However, Ukraine has avoided a price hike this quarter, and whether by turning over some energy assets or by clever accounting moves, Ukraine could avoid a price increase for next year's supplies.

With the installation of the Yanukovich government, U.S. attention to Ukraine has somewhat waned. Investment in Ukraine has been steadily increasing, but the percentage of that investment that comes from the United States has decreased from 18.6 percent in 2003 to just more than 8 percent in 2006. The European Union's interest in Ukraine, however, has not faded, as evidenced by the EU Commission's Sept. 13 announcement that it wants to begin free trade negotiations with Ukraine. Russia will not react well to the EU effort to pull Ukraine's economic activity westward, and will spend the fourth quarter pressuring the heads of EU member states, which must approve the move before negotiations can begin. Energy is likely to be a primary tool in the ensuing arm-twisting.

Russia will also keep its attention on the Caucasus, both north and south. No Chechen militants of any import have responded to the Kremlin's amnesty for Chechen insurgents who have not committed violent crimes, and the policy is unlikely to succeed, even as Putin shepherds the legislation that would extend the deadline. Rebel attacks against local authorities will continue until the weather slows down the insurgents' activity toward the end of the quarter.

The Nagorno-Karabakh conflict will remain unresolved, even as more talks take place. Though Azerbaijan is building up its military, its progress has been unremarkable. However, Azerbaijan will experience another financial boon in the fourth quarter - in addition to the opening of the Baku-Tbilisi-Ceyhan oil pipeline earlier this year -- as the South Caucasus (Shah Deniz) natural gas pipeline is slated to come online by December.

Georgia will continue to be engrossed in the conflict with its two secessionist republics, Abkhazia and South Ossetia. The latter has called a referendum on independence for Nov. 12, set to coincide with the election of the unrecognized republic's president. The event will draw no international recognition except from its backer, Russia. South Ossetian and Abkhazian separatist groups will continue to create unrest in the region until the cold weather sets in. Georgia will be unhappy if it is not offered a path to NATO membership, but with recent NATO guarantees of expanded cooperation, it will nevertheless maintain its cooperation with U.S. military advisers. Russia will seek to perpetuate separatism to weaken Georgia and thwart its NATO ambitions.

The Central Asian regimes will continue to crack down on what they term an Islamist insurgency. Attacks and bombings remain possible, as the level of discontent is generally high in the region. Tajikistan is holding presidential elections Nov. 6, and President Emomali Rakhmonov is set to win, as he has public support and no viable opposition. The Kyrgyz government will remain in an uneasy stasis, as no one faction is strong enough to usurp the others. The Central Asian nations will expand their economic cooperation with East Asian nations while remaining at least nonconfrontational toward, if not loyal to, Moscow; China has strategic interests in Central Asia, particularly in military cooperation.

Moscow's relationship with Beijing will continue to be characterized by nationalist and protectionist tendencies. The two countries will talk about expanding economic and energy cooperation, but few such projects will proceed. Without the need to respond to external pressure from the United States, the two giants are unlikely to form a strategic alliance, something they would consider only to thwart U.S. power.

In the Middle East, Russia will not turn away from economic cooperation with Iran. While defending Tehran's right to civilian nuclear technology, Russia has taken the cautious stance of saying Iran should be punished only if it is engaging in illegal activities. Still, Russia is likely to abstain from a U.N. Security Council resolution on sanctions; a veto is also possible. Russian contacts with other players in the region -- such as Lebanon, Syria and the Palestinian National Authority -- will continue, much to U.S. chagrin.

fecha |

Título |

18/11/2016| |

|

17/04/2016| |

|

27/03/2016| |

|

12/02/2016| |

|

25/10/2013| |

|

29/09/2013| |

|

12/09/2013| |

|

08/09/2013| |

|

06/09/2013| |

|

26/08/2013| |

|

20/08/2013| |

|

20/08/2013| |

|

07/08/2013| |

|

06/08/2013| |

|

31/07/2013| |

|

20/07/2013| |

|

16/07/2013| |

|

03/07/2013| |

|

02/07/2013| |

|

02/07/2013| |

|

01/07/2013| |

|

01/07/2013| |

|

01/07/2013| |

|

05/06/2013| |

|

27/05/2013| |

|

27/05/2013| |

|

27/05/2013| |

|

02/05/2013| |

|

30/04/2013| |

|

19/04/2013| |

|

17/04/2013| |

|

04/03/2013| |

|

01/03/2013| |

|

18/01/2013| |

|

16/11/2012| |

|

16/11/2012| |

|

15/11/2012| |

|

03/08/2011| |

|

03/08/2011| |

|

29/07/2011| |

|

17/07/2011| |

|

17/07/2011| |

|

14/07/2011| |

|

14/07/2011| |

|

13/07/2011| |

|

13/07/2011| |

|

13/07/2011| |

|

13/07/2011| |

|

06/07/2011| |

|

06/07/2011| |

|

07/06/2011| |

|

07/06/2011| |

|

20/05/2011| |

|

20/05/2011| |

|

02/05/2011| |

|

02/05/2011| |

|

19/03/2011| |

|

17/03/2011| |

|

14/03/2011| |

|

12/03/2011| |

|

12/03/2011| |

|

12/03/2011| |

|

12/03/2011| |

|

12/03/2011| |

|

03/03/2011| |

|

22/02/2011| |

|

21/02/2011| |

|

12/02/2011| |

|

01/02/2011| |

|

30/01/2011| |

|

29/01/2011| |

|

28/01/2011| |

|

19/01/2011| |

|

07/01/2011| |

|

29/12/2010| |

|

17/12/2010| |

|

16/12/2010| |

|

10/12/2010| |

|

24/11/2010| |

|

23/11/2010| |

|

15/04/2010| |

|

15/04/2010| |

|

03/04/2009| |

|

31/03/2009| |

|

31/03/2009| |

|

30/03/2009| |

|

30/03/2009| |

|

28/03/2009| |

|

28/03/2009| |

|

26/03/2009| |

|

25/03/2009| |

|

25/03/2009| |

|

23/03/2009| |

|

23/03/2009| |

|

20/03/2009| |

|

19/03/2009| |

|

19/03/2009| |

|

19/03/2009| |

|

19/03/2009| |

|

17/03/2009| |

|

17/03/2009| |

|

17/03/2009| |

|

17/03/2009| |

|

17/03/2009| |

|

17/03/2009| |

|

15/03/2009| |

|

15/03/2009| |

|

14/03/2009| |

|

14/03/2009| |

|

12/03/2009| |

|

12/03/2009| |

|

12/03/2009| |

|

12/03/2009| |

|

11/03/2009| |

|

11/03/2009| |

|

10/03/2009| |

|

10/03/2009| |

|

07/03/2009| |

|

07/03/2009| |

|

07/03/2009| |

|

07/03/2009| |

|

07/03/2009| |

|

07/03/2009| |

|

05/03/2009| |

|

05/03/2009| |

|

05/03/2009| |

|

05/03/2009| |

|

05/03/2009| |

|

05/03/2009| |

|

28/02/2009| |

|

28/02/2009| |

|

28/02/2009| |

|

28/02/2009| |

|

27/02/2009| |

|

27/02/2009| |

|

27/02/2009| |

|

27/02/2009| |

|

19/02/2009| |

|

19/02/2009| |

|

19/02/2009| |

|

19/02/2009| |

|

31/01/2009| |

|

31/01/2009| |

|

31/01/2009| |

|

23/01/2009| |

|

23/01/2009| |

|

18/01/2009| |

|

13/01/2009| |

|

05/01/2009| |

|

02/01/2009| |

|

25/12/2008| |

|

25/12/2008| |

|

24/12/2008| |

|

24/12/2008| |

|

19/12/2008| |

|

14/12/2008| |

|

14/12/2008| |

|

13/12/2008| |

|

13/12/2008| |

|

07/12/2008| |

|

07/12/2008| |

|

27/11/2008| |

|

27/11/2008| |

|

27/11/2008| |

|

27/11/2008| |

|

27/11/2008| |

|

27/11/2008| |

|

27/11/2008| |

|

27/11/2008| |

|

27/11/2008| |

|

27/11/2008| |

|

27/11/2008| |

|

27/11/2008| |

|

26/11/2008| |

|

26/11/2008| |

|

25/10/2008| |

|

25/10/2008| |

|

22/10/2008| |

|

22/10/2008| |

|

15/10/2008| |

|

15/10/2008| |

|

15/10/2008| |

|

15/10/2008| |

|

15/10/2008| |

|

15/10/2008| |

|

11/10/2008| |

|

11/10/2008| |

|

08/10/2008| |

|

08/10/2008| |

|

20/09/2008| |

|

20/09/2008| |

|

20/09/2008| |

|

20/09/2008| |

|

14/09/2008| |

|

14/09/2008| |

|

14/09/2008| |

|

14/09/2008| |

|

08/08/2008| |

|

08/08/2008| |

|

27/07/2008| |

|

27/07/2008| |

|

27/07/2008| |

|

27/07/2008| |

|

27/07/2008| |

|

27/07/2008| |

|

27/07/2008| |

|

27/07/2008| |

|

04/07/2008| |

|

04/07/2008| |

|

04/07/2008| |

|

04/07/2008| |

|

04/07/2008| |

|

04/07/2008| |

|

12/05/2008| |

|

17/04/2008| |

|

17/04/2008| |

|

25/03/2008| |

|

24/03/2008| |

|

24/03/2008| |

|

18/03/2008| |

|

18/03/2008| |

|

10/03/2008| |

|

07/03/2008| |

|

22/02/2008| |

|

22/02/2008| |

|

22/02/2008| |

|

18/02/2008| |

|

18/02/2008| |

|

18/02/2008| |

|

16/02/2008| |

|

13/02/2008| |

|

12/02/2008| |

|

09/02/2008| |

|

05/01/2008| |

|

30/12/2007| |

|

30/12/2007| |

|

30/12/2007| |

|

27/12/2007| |

|

21/11/2007| |

|

21/11/2007| |

|

21/11/2007| |

|

21/11/2007| |

|

21/11/2007| |

|

21/11/2007| |

|

21/11/2007| |

|

11/11/2007| |

|

10/11/2007| |

|

30/10/2007| |

|

04/10/2007| |

|

28/09/2007| |

|

16/09/2007| |

|

16/09/2007| |

|

08/09/2007| |

|

06/09/2007| |

|

30/08/2007| |

|

26/08/2007| |

|

22/08/2007| |

|

22/08/2007| |

|

22/08/2007| |

|

21/08/2007| |

|

11/08/2007| |

|

08/08/2007| |

|

14/07/2007| |

|

02/05/2007| |

|

02/05/2007| |

|

20/04/2007| |

|

20/04/2007| |

|

20/04/2007| |

|

20/04/2007| |

|

18/04/2007| |

|

18/04/2007| |

|

18/04/2007| |

|

18/04/2007| |

|

16/04/2007| |

|

16/04/2007| |

|

16/04/2007| |

|

16/04/2007| |

|

16/04/2007| |

|

16/04/2007| |

|

16/04/2007| |

|

16/04/2007| |

|

14/04/2007| |

|

14/04/2007| |

|

14/04/2007| |

|

14/04/2007| |

|

13/04/2007| |

|

13/04/2007| |

|

11/04/2007| |

|

11/04/2007| |

|

11/04/2007| |

|

11/04/2007| |

|

04/04/2007| |

|

04/04/2007| |

|

31/03/2007| |

|

30/03/2007| |

|

30/03/2007| |

|

30/03/2007| |

|

30/03/2007| |

|

28/03/2007| |

|

20/03/2007| |

|

20/03/2007| |

|

20/03/2007| |

|

20/03/2007| |

|

15/03/2007| |

|

15/03/2007| |

|

15/03/2007| |

|

08/03/2007| |

|

08/03/2007| |

|

08/03/2007| |

|

08/03/2007| |

|

01/03/2007| |

|

28/02/2007| |

|

27/02/2007| |

|

27/02/2007| |

|

27/02/2007| |

|

27/02/2007| |

|

27/02/2007| |

|

27/02/2007| |

|

27/02/2007| |

|

08/02/2007| |

|

08/02/2007| |

|

08/02/2007| |

|

08/02/2007| |

|

07/02/2007| |

|

07/02/2007| |

|

07/02/2007| |

|

07/02/2007| |

|

05/02/2007| |

|

05/02/2007| |

|

05/02/2007| |

|

05/02/2007| |

|

05/02/2007| |

|

05/02/2007| |

|

05/02/2007| |

|

05/02/2007| |

|

05/02/2007| |

|

05/02/2007| |

|

05/02/2007| |

|

05/02/2007| |

|

02/02/2007| |

|

02/02/2007| |

|

01/02/2007| |

|

01/02/2007| |

|

01/02/2007| |

|

01/02/2007| |

|

31/01/2007| |

|

31/01/2007| |

|

25/01/2007| |

|

25/01/2007| |

|

23/01/2007| |

|

23/01/2007| |

|

23/01/2007| |

|

23/01/2007| |

|

10/01/2007| |

|

10/01/2007| |

|

03/01/2007| |

|

30/12/2006| |

|

30/12/2006| |

|

30/12/2006| |

|

30/12/2006| |

|

30/12/2006| |

|

30/12/2006| |

|

23/12/2006| |

|

23/12/2006| |

|

23/12/2006| |

|

23/12/2006| |

|

23/12/2006| |

|

23/12/2006| |

|

23/12/2006| |

|

23/12/2006| |

|

23/12/2006| |

|

23/12/2006| |

|

20/12/2006| |

|

20/12/2006| |

|

20/12/2006| |

|

20/12/2006| |

|

16/12/2006| |

|

16/12/2006| |

|

16/12/2006| |

|

16/12/2006| |

|

16/12/2006| |

|

16/12/2006| |

|

15/12/2006| |

|

15/12/2006| |

|

15/12/2006| |

|

15/12/2006| |

|

15/12/2006| |

|

15/12/2006| |

|

12/12/2006| |

|

12/12/2006| |

|

12/12/2006| |

|

12/12/2006| |

|

12/12/2006| |

|

12/12/2006| |

|

05/12/2006| |

|

05/12/2006| |

|

05/12/2006| |

|

05/12/2006| |

|

05/12/2006| |

|

05/12/2006| |

|

02/12/2006| |

|

02/12/2006| |

|

29/11/2006| |

|

29/11/2006| |

|

29/11/2006| |

|

29/11/2006| |

|

22/11/2006| |

|

22/11/2006| |

|

22/11/2006| |

|

22/11/2006| |

|

18/11/2006| |

|

18/11/2006| |

|

17/11/2006| |

|

16/11/2006| |

|

14/11/2006| |

|

13/11/2006| |

|

11/11/2006| |

|

11/11/2006| |

|

11/11/2006| |

|

08/11/2006| |

|

07/11/2006| |

|

07/11/2006| |

|

04/11/2006| |

|

04/11/2006| |

|

01/11/2006| |

|

31/10/2006| |

|

31/10/2006| |

|

31/10/2006| |

|

28/10/2006| |

|

28/10/2006| |

|

24/10/2006| |

|

24/10/2006| |

|

24/10/2006| |

|

24/10/2006| |

|

21/10/2006| |

|

21/10/2006| |

|

18/10/2006| |

|

18/10/2006| |

|

18/10/2006| |

|

18/10/2006| |

|

18/10/2006| |

|

14/10/2006| |

|

14/10/2006| |

|

14/10/2006| |

|

14/10/2006| |

|

14/10/2006| |

|

14/10/2006| |

|

07/10/2006| |

|

05/10/2006| |

|

05/10/2006| |

|

05/10/2006| |

|

29/09/2006| |

|

28/09/2006| |

|

27/09/2006| |

|

27/09/2006| |

|

27/09/2006| |

|

24/09/2006| |

|

23/09/2006| |

|

23/09/2006| |

|

23/09/2006| |

|

30/08/2006| |

|

30/08/2006| |

|

27/08/2006| |

|

02/08/2006| |

|

02/08/2006| |

|

30/07/2006| |

|

30/07/2006| |

|

28/07/2006| |

|

28/07/2006| |

|

23/07/2006| |

|

19/07/2006| |

|

15/07/2006| |

|

14/07/2006| |

|

06/07/2006| |

|

06/07/2006| |

|

06/07/2006| |

|

06/07/2006| |

|

30/06/2006| |

|

30/06/2006| |

|

30/06/2006| |

|

30/06/2006| |

|

30/06/2006| |

|

30/06/2006| |

|

26/06/2006| |

|

26/06/2006| |

|

24/06/2006| |

|

24/06/2006| |

|

22/06/2006| |

|

22/06/2006| |

|

20/06/2006| |

|

20/06/2006| |

|

20/06/2006| |

|

20/06/2006| |

|

20/06/2006| |

|

20/06/2006| |

|

20/06/2006| |

|

20/06/2006| |

|

05/06/2006| |

|

04/06/2006| |

|

03/06/2006| |

|

02/06/2006| |

|

02/06/2006| |

|

01/06/2006| |

|

01/06/2006| |

|

31/05/2006| |

|

29/05/2006| |

|

28/05/2006| |

|

23/05/2006| |

|

17/05/2006| |

|

17/05/2006| |

|

13/05/2006| |

|

07/05/2006| |

|

07/05/2006| |

|

06/05/2006| |

|

06/05/2006| |

|

04/05/2006| |

|

02/05/2006| |

|

02/05/2006| |

|

30/04/2006| |

|

25/04/2006| |

|

24/04/2006| |

|

24/04/2006| |

|

23/04/2006| |

|

23/04/2006| |

|

21/04/2006| |

|

21/04/2006| |

|

21/04/2006| |

|

18/04/2006| |

|

18/04/2006| |

|

18/04/2006| |

|

18/04/2006| |

|

17/04/2006| |

|

13/04/2006| |

|

13/04/2006| |

|

10/04/2006| |

|

08/04/2006| |

|

06/04/2006| |

|

06/04/2006| |

|

05/04/2006| |

|

30/03/2006| |

|

28/03/2006| |

|

28/03/2006| |

|

27/03/2006| |

|

24/03/2006| |

|

24/03/2006| |

|

24/03/2006| |

|

24/03/2006| |

|

24/03/2006| |

|

24/03/2006| |

|

22/03/2006| |

|

22/03/2006| |

|

20/02/2006| |

|

20/02/2006| |

|

18/02/2006| |

|

11/02/2006| |

|

11/02/2006| |

|

11/02/2006| |

|

07/02/2006| |

|

26/01/2006| |

|

25/01/2006| |

|

22/01/2006| |

|

19/01/2006| |

|

19/01/2006| |

|

14/01/2006| |

|

14/01/2006| |

|

12/01/2006| |

|

12/01/2006| |

|

06/01/2006| |

|

20/12/2005| |

|

01/08/2005| |

|

06/01/2005| |

|